Public Finance(第十版) | 維持健康的好方法 - 2024年7月

Public Finance(第十版)

1.Changes to Tax Law: Several chapters have been updated to reflect the tax changes as a result of the American Taxpayer Relief Act of 2012, including increased tax rates, and changes in the taxation of capital gains and dividends, the estate tax, and the Alternative Minimum Tax.

2.Taxation of Multinational Corporations: Chapter 19, The Corporation Tax, now includes an expanded discussion on the debate about how the U.S. should tax corporate profits earned abroad by domestic firms, with an evaluation of two alternative systems: global taxation and territorial taxation of corporate profits.

3.Health Care: Chapter 10, Government and the Market for Health Care, now includes a discussion of the Affordable Care Act, with a particular focus on the mandate that everyone purchase health insurance.

4.Federal Debt: In light of recent years, the issue of whether high levels of debt can lead to fiscal crisis is now taken up in the chapter on deficit finance.

作者簡介

Harvey S. Rosen

現職:Princeton University

Ted Gayer

現職:Brookings Institution

PART I: GETTING STARTED

ch 1 Introduction

ch 2 Tools of Positive Analysis

ch 3 Tools of Normative Analysis

PART II: PUBLIC EXPENDITURE: PUBLIC GOODS AND EXTERNALITIES

ch 4 Public Goods

ch 5 Externalities

ch 6 Political Economy

ch 7 Education

ch 8 Cost-Benefit Analysis

PART III: PUBLIC EXPENDITURES: SOCIAL INSURANCE AND INCOME MAINTENANCE

ch 9 The Health Care Market

ch 10 Government and the Market for Health Care

ch 11 Social Security

ch 12 Income Redistribution: Conceptual Issues

ch 13 Expenditure Programs for the Poor

PART IV: FRAMEWORK FOR TAX ANALYSIS

ch 14 Taxation and Income Distribution

ch 15 Taxation and Efficiency

ch 16 Efficient and Equitable Taxation

PART V: THE UNITED STATES REVENUE SYSTEM

ch 17 The Personal Income Tax

ch 18 Personal Taxation and Behavior

ch 19 The Corporation Tax

ch 20 Deficit Finance

ch 21 Fundamental Tax Reform: Taxes on Consumption and Wealth

PART VI: MULTIGOVERNMEN PUBLIC FINANCE

ch 22 Public Finance in a Federal System

週一週四2天輕斷食,8週瘦8公斤不...

週一週四2天輕斷食,8週瘦8公斤不... 234瘦身飲食法:美女營養師實證!...

234瘦身飲食法:美女營養師實證!... 高代謝地中海料理:我這樣吃瘦了36...

高代謝地中海料理:我這樣吃瘦了36... 21天斷糖排毒法:3週252種全食...

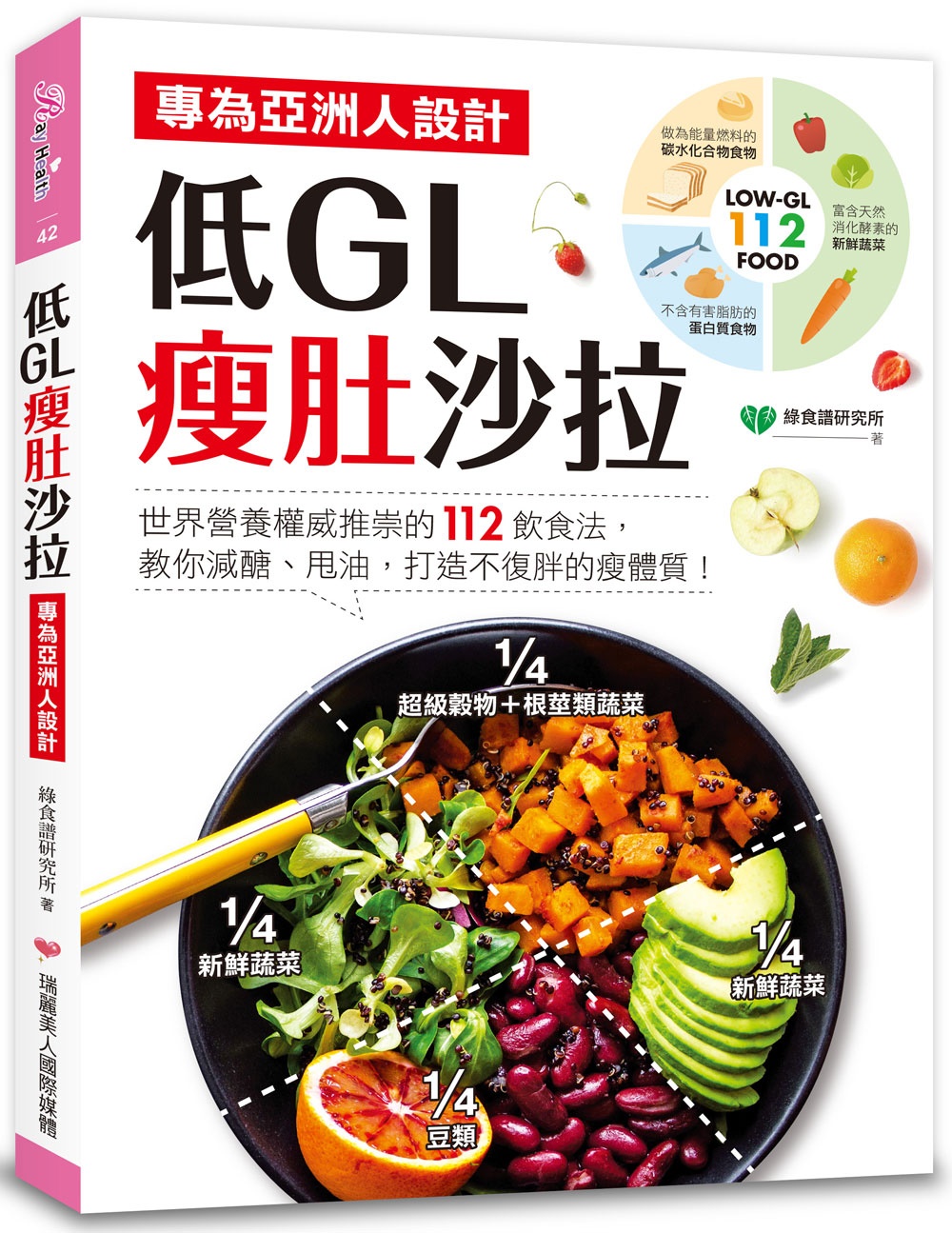

21天斷糖排毒法:3週252種全食... 低GL瘦肚沙拉:專為亞洲人設計!世...

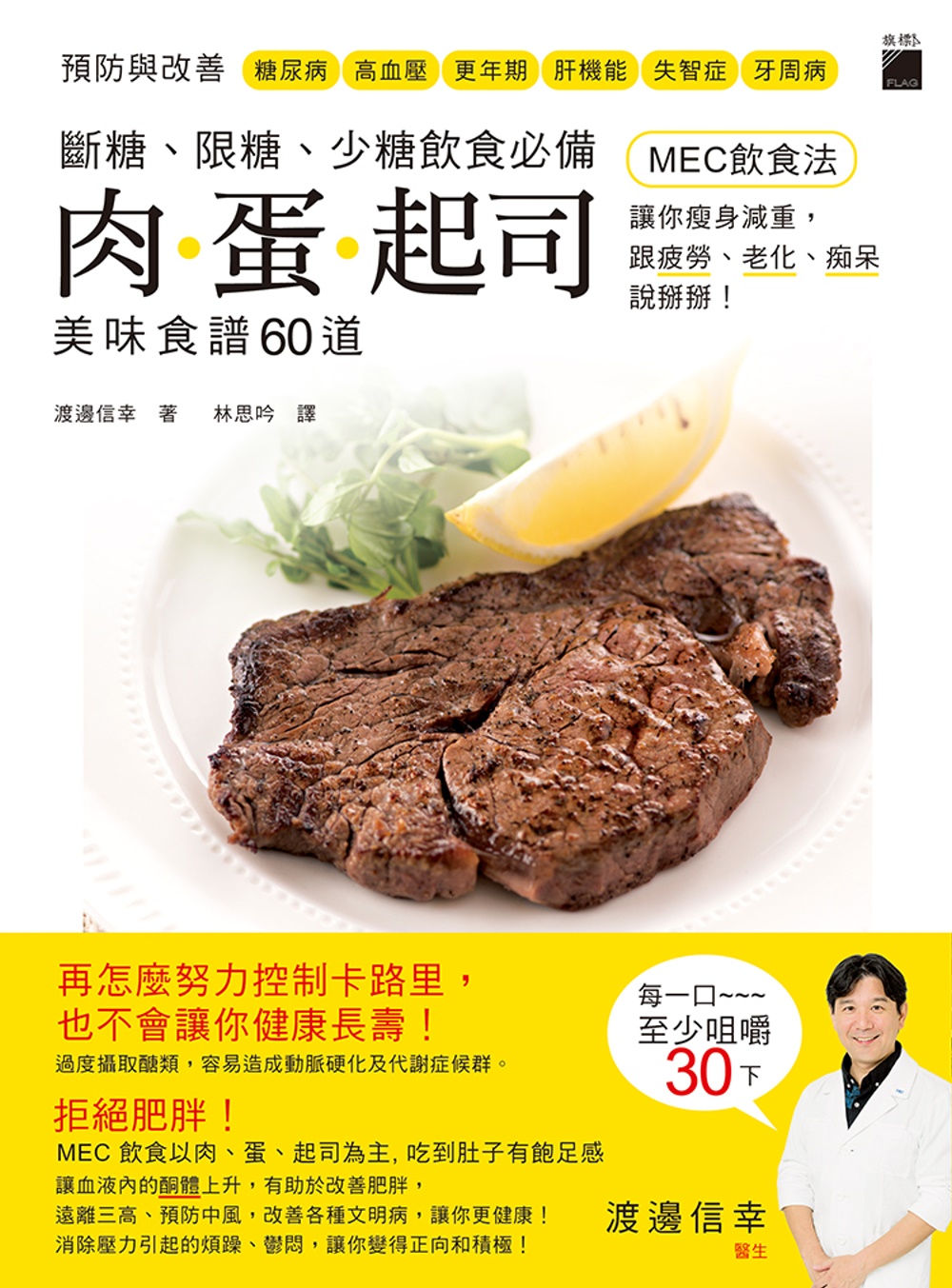

低GL瘦肚沙拉:專為亞洲人設計!世... 斷糖、限糖、少糖飲食必備:肉.蛋....

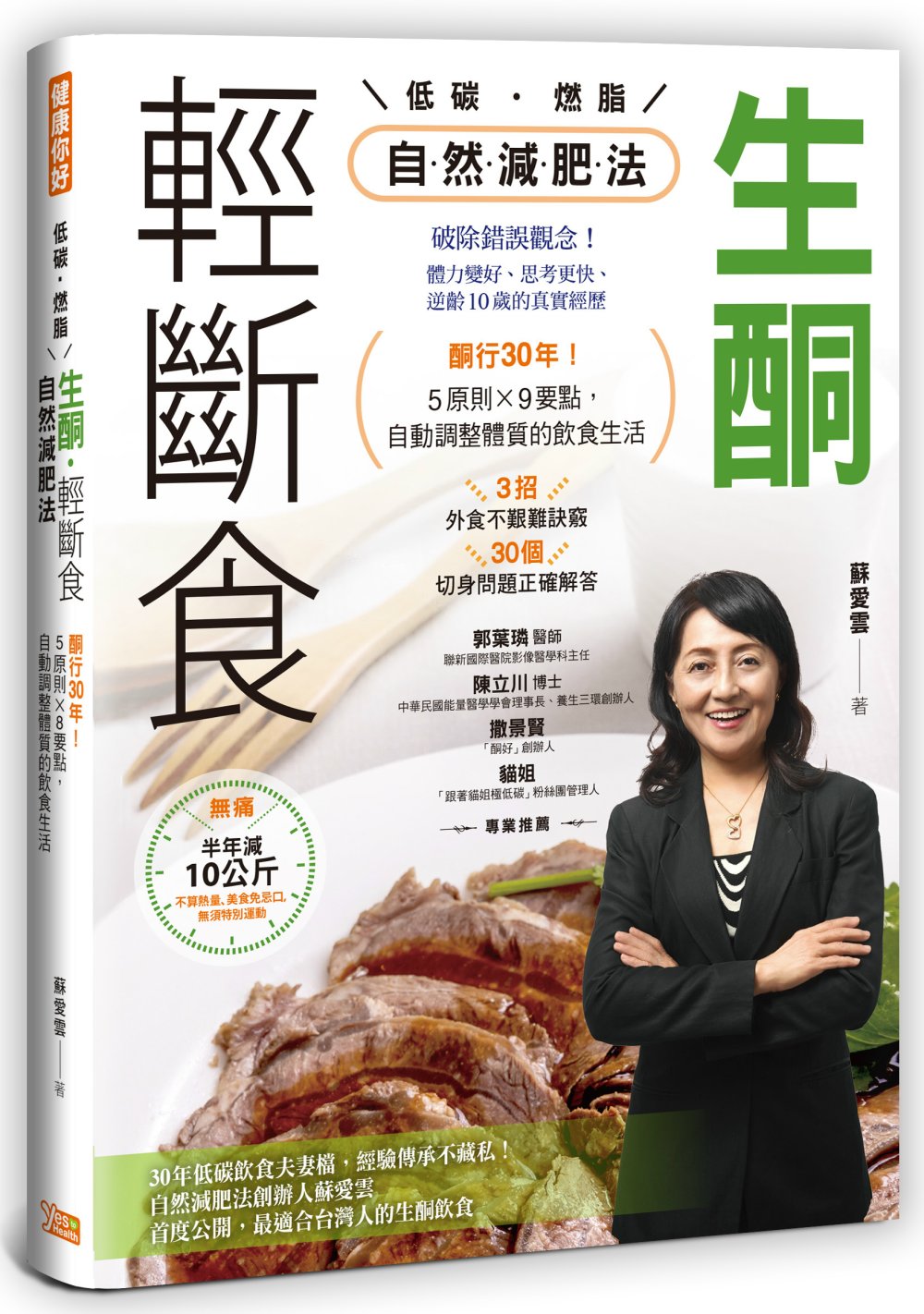

斷糖、限糖、少糖飲食必備:肉.蛋.... 生酮.輕斷食自然減肥法:酮行30年...

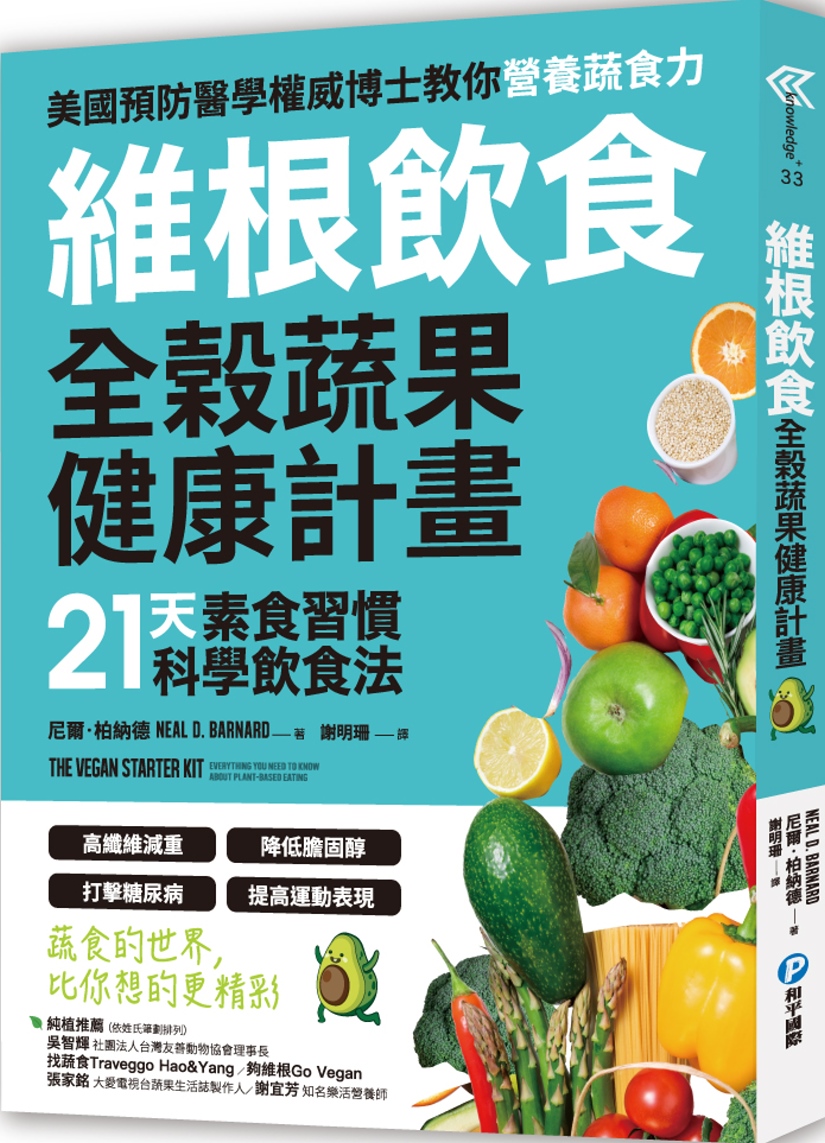

生酮.輕斷食自然減肥法:酮行30年... 維根飲食.全榖蔬果健康計畫:21天...

維根飲食.全榖蔬果健康計畫:21天... 椰子生酮飲食代謝法:促進新陳代謝、...

椰子生酮飲食代謝法:促進新陳代謝、... 裸食瘦身:真人實證!Raw Foo...

裸食瘦身:真人實證!Raw Foo...